ATTENTION BUSINESSES RUNNING ADS

TURN EVERY LEAD INTO A BOOKED CALL AUTOMATICALLY

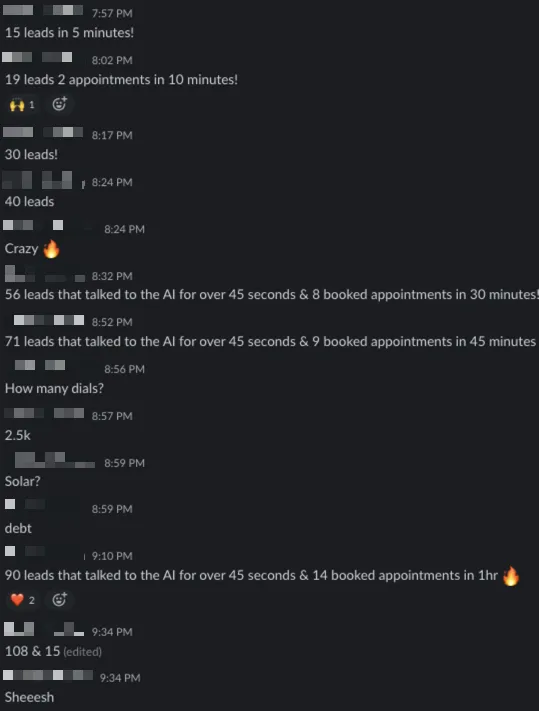

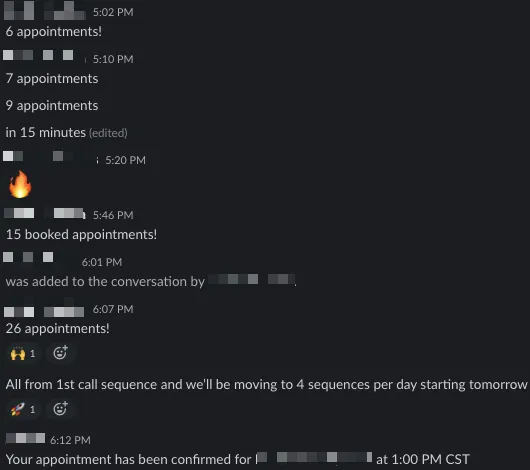

CLIENTS ARE SEEING UP TO 127% MORE CONVERSATIONS AND 74% MORE BOOKINGS

Meet Your 24/7 AI sales team

instantly calls, texts, emails and DMs every new lead-sounding like your top rep

Reach every lead in < 60 seconds

Book qualified calls automatically - calendar fills itself

Slash outbound payroll, no setters, no SDRs, no VA's needed

Human-sounding AI that prospects want to talk to

Custom built & integrated for you

Get Ahead of Your Competitors

Fill In Your Details Below

#1: Selecting a strategy, #2: Analyzing Markets, #3: Evaluating Properties, #4: Creating An Unforgettable Experience, #5: Acquiring The Necessary Permits, #6: Professional Photos, #7: Listings & Automations

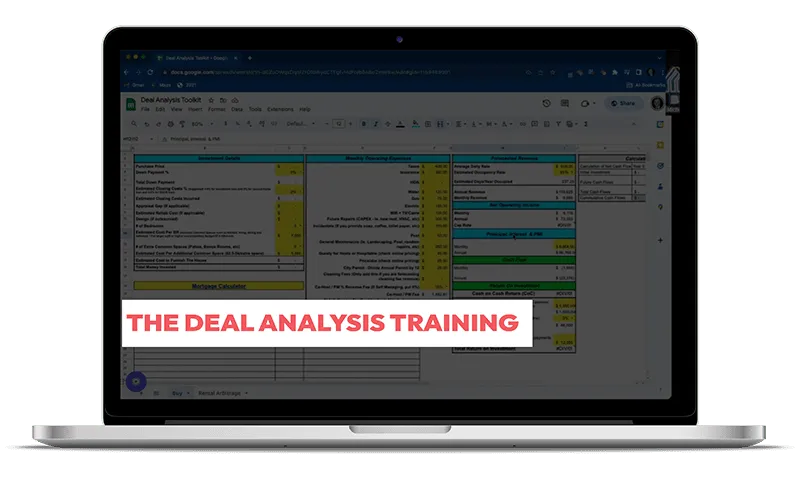

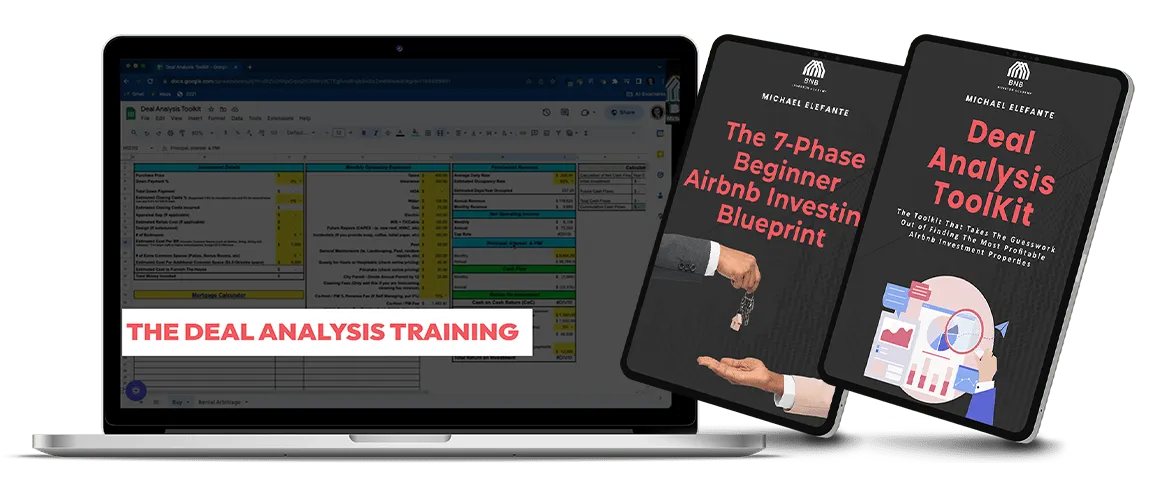

Inside the 7-Figure ‘Short Term Rental Bundle’ you’ll get the exact toolkit I use to calculate the:Total upfront investment, Monthly operating expenses, Forecasted revenue, and Monthly cash flow

This is a 15-minute training where I walk you through exactly how to use the ‘Deal Analysis Toolkit’ by filling it in with real numbers so you don’t get hopelessly overwhelmed when trying to use it yourself.

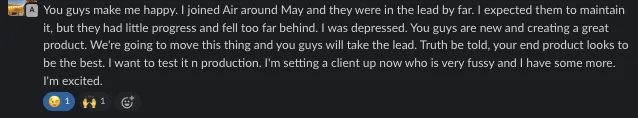

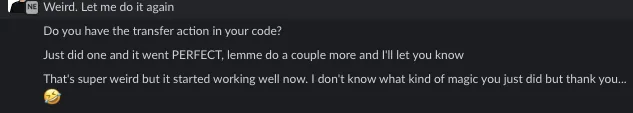

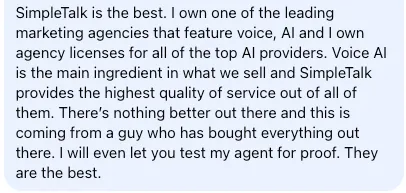

TESTIMONIALS

see Proven results below

Copyrights 2024 | Simpletalk™

This website is operated and maintained by Simpletalk AI. Use of the website is governed by its Terms Of Service and Privacy Policy.

Simpetalk AI is a software and service company. We do not sell a business opportunity, “get rich quick” program or money-making system. We believe, with education, individuals and businesses can be better prepared to make investment decisions, but we do not guarantee success in our software or system. We do not make earnings claims, efforts claims, or claims that our training will make you any money. All material is intellectual property and protected by copyright. Any duplication, reproduction, or distribution is strictly prohibited.

The 7-Figure ‘Short-Term Rental Bundle’

Inside the bundle you’ll discover:

Number 1

Number 1

The 7-Phase Beginner Airbnb Investing Blueprint

The 7-Phase Beginner Airbnb Investing Blueprint

Phase #1: Selecting a strategy

When it comes to short-term rentals, there are multiple strategies that you can pick from. Which one you choose to go with depends on your goals, resources, etc… so it’s important to understand all of the options that you have available.

During this phase, you’ll discover:

The 3 main strategies that you can use to start your short-term rental business as soon as today

How you can generate profits with Airbnb without owning a single property yourself

How to get started in short-term rentals with $0 (It all comes down to building relationships)

Phase #2: Analyzing Markets

The main thing that separates the investors who barely break even at the end of the month from those who take home 4-5 Figures of sweet profits is their ability to analyze markets.

Pick a good market, and even a meh property will somehow manage to survive, pick a bad market and even the best one will flop.

In this phase, you’ll uncover:

The #1 indicator you should look for when evaluating a market to guarantee that it’s in high demand

Why popular tourist destinations are NOT a good place for having a short-term rental

The “magical” tool that does all of the heavy lifting for me when I’m analyzing a market

Phase #3: Evaluating Properties

Picking the right market to invest in is as important as picking the right property in that market… Remember, you’re one GOOD property away from replacing your 9-5 job. The exact metric I care the most about when evaluating a certain property (It’s not the revenue, ROI, etc…)

During this phase, you’ll learn:

The precise returns I strive for when investing in short-term rentals based on the investment strategy I’m going for

Why the fact that you love a certain property doesn’t mean that it’s the right one to invest in

The exact metric I care the most about when evaluating a property (It’s not the revenue, ROI, etc…)

Phase #4: Creating An Unforgettable Experience

Many people think that Airbnb is too saturated…and to be completely honest…I’ll have to agree. It’s saturated with BAD PROPERTIES. That’s why in this phase I’ll show you:

Why guests couldn’t care less about the property itself (plus what they actually care about)

The 4-Step “Listing Dissection” Process to craft what I call your ‘property vision’ so you can stand out from the crowd

The 3 things to take into account when furnishing a property to make sure that you get it right

Phase #5: Acquiring The Necessary Permits

I know, I know…that’s the boring part but you can’t invest in short-term rentals if you don’t have the necessary permits.

Well…maybe you can but the penalties can include hefty fines, forced closure of your business, or even legal action.

That’s why in this phase I’ll show you how you can find your city’s unique rules in 2 simple steps so you can ensure that you’re on the right side of the law.

Phase #6: Professional Photos

Despite what you might think, the photos you showcase can make or break a guest’s decision to book.

As we all probably know: “The first impression is the last impression.”

Here, I’ll walk you through how to acquire stunning photos that will sell guests on your property before they even see the listing.

Phase #7: Listings & Automations

To turn Airbnb into an almost passive income stream that will bring you hands-free profits month after month with just 30 minutes per week of work, you’ll need to automate it.

In this phase, you’ll uncover:

The “Social Media Profile” Framework for setting up a winning property listing

The “Best for First” trick to stop potential guests dead in their tracks when they come across your listing

The ‘Software Trifecta’ I use to automate 90% of my day-to-day tasks as an Airbnb host

Number 2

The Deal Analysis Toolkit

Inside the 7-Figure ‘Short Term Rental Bundle’ you’ll get the exact toolkit I use to calculate the:

Total upfront investment

Monthly operating expenses

Forecasted revenue

Monthly cash flow

…And most importantly the cash on cash return of a property that I’m planning to either buy, or rent and sublet on Airbnb.

This will allow you to determine whether a property you’ve been planning to get your hands on is worth the investment before pulling the trigger.

Number 2

The Deal Analysis Toolkit

The main thing that separates the investors who barely break even at the end of the month from those who take home 4-5 Figures of sweet profits is their ability to analyze markets.

Pick a good market, and even a meh property will somehow manage to survive, pick a bad market and even the best one will flop.

In this phase, you’ll uncover:

The #1 indicator you should look for when evaluating a market to guarantee that it’s in high demand

Why popular tourist destinations are NOT a good place for having a short-term rental

The “magical” tool that does all of the heavy lifting for me when I’m analyzing a market

The 7-Figure ‘Short-Term Rental Bundle’

Inside the bundle you’ll discover:

Number 1

The 7-Phase Beginner Airbnb Investing Blueprint

Phase #1: Selecting a strategy

When it comes to short-term rentals, there are multiple strategies that you can pick from. Which one you choose to go with depends on your goals, resources, etc… so it’s important to understand all of the options that you have available.

During this phase, you’ll discover:

The 3 main strategies that you can use to start your short-term rental business as soon as today

How you can generate profits with Airbnb without owning a single property yourself

How to get started in short-term rentals with $0 (It all comes down to building relationships)

Phase #2: Analyzing Markets

The main thing that separates the investors who barely break even at the end of the month from those who take home 4-5 Figures of sweet profits is their ability to analyze markets.

Pick a good market, and even a meh property will somehow manage to survive, pick a bad market and even the best one will flop.

In this phase, you’ll uncover:

The #1 indicator you should look for when evaluating a market to guarantee that it’s in high demand

Why popular tourist destinations are NOT a good place for having a short-term rental

The “magical” tool that does all of the heavy lifting for me when I’m analyzing a market

Phase #3: Evaluating Properties

Picking the right market to invest in is as important as picking the right property in that market… Remember, you’re one GOOD property away from replacing your 9-5 job. The exact metric I care the most about when evaluating a certain property (It’s not the revenue, ROI, etc…)

During this phase, you’ll learn:

The precise returns I strive for when investing in short-term rentals based on the investment strategy I’m going for

Why the fact that you love a certain property doesn’t mean that it’s the right one to invest in

The exact metric I care the most about when evaluating a property (It’s not the revenue, ROI, etc…)

Phase #2: Analyzing Markets

The main thing that separates the investors who barely break even at the end of the month from those who take home 4-5 Figures of sweet profits is their ability to analyze markets.

Pick a good market, and even a meh property will somehow manage to survive, pick a bad market and even the best one will flop.

In this phase, you’ll uncover:

The #1 indicator you should look for when evaluating a market to guarantee that it’s in high demand

Why popular tourist destinations are NOT a good place for having a short-term rental

The “magical” tool that does all of the heavy lifting for me when I’m analyzing a market

Phase #2: Analyzing Markets

The main thing that separates the investors who barely break even at the end of the month from those who take home 4-5 Figures of sweet profits is their ability to analyze markets.

Pick a good market, and even a meh property will somehow manage to survive, pick a bad market and even the best one will flop.

In this phase, you’ll uncover:

The #1 indicator you should look for when evaluating a market to guarantee that it’s in high demand

Why popular tourist destinations are NOT a good place for having a short-term rental

The “magical” tool that does all of the heavy lifting for me when I’m analyzing a market

Number 2

The Deal Analysis Toolkit

Inside the 7-Figure ‘Short Term Rental Bundle’ you’ll get the exact toolkit I use to calculate the:

Total upfront investment

Monthly operating expenses

Forecasted revenue

Monthly cash flow

…And most importantly the cash on cash return of a property that I’m planning to either buy, or rent and sublet on Airbnb.

This will allow you to determine whether a property you’ve been planning to get your hands on is worth the investment before pulling the trigger.

Number 2

The Deal Analysis Toolkit

The main thing that separates the investors who barely break even at the end of the month from those who take home 4-5 Figures of sweet profits is their ability to analyze markets.

Pick a good market, and even a meh property will somehow manage to survive, pick a bad market and even the best one will flop.

In this phase, you’ll uncover:

The #1 indicator you should look for when evaluating a market to guarantee that it’s in high demand

Why popular tourist destinations are NOT a good place for having a short-term rental

The “magical” tool that does all of the heavy lifting for me when I’m analyzing a market